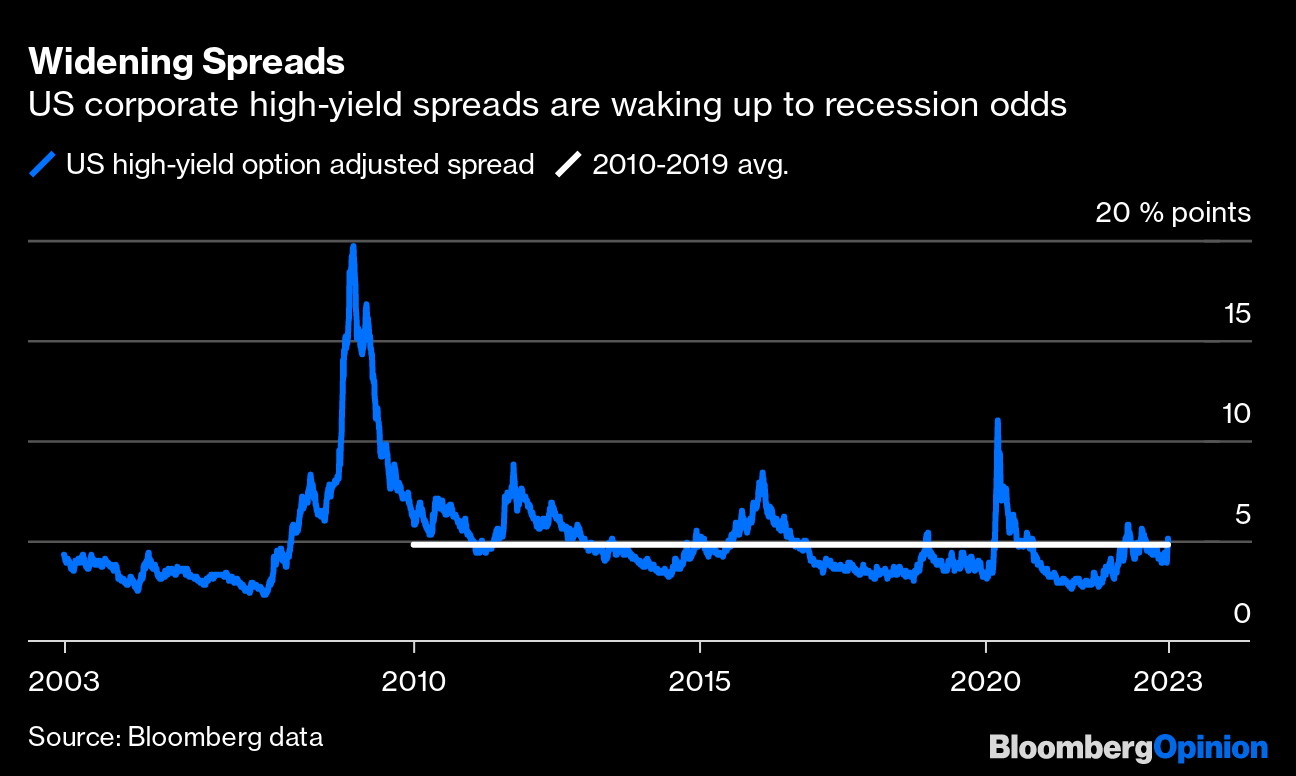

Spreads Widen On Bonds . A widening spread generally indicates that investors demand a higher return for. a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. bond yield spreads are a barometer of economic health and market sentiment. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm). Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data.

from fabalabse.com

credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm). bond yield spreads are a barometer of economic health and market sentiment. when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data. A widening spread generally indicates that investors demand a higher return for.

Are widening spreads good or bad? Leia aqui What do widening spreads

Spreads Widen On Bonds Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data. a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm). when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. A widening spread generally indicates that investors demand a higher return for. bond yield spreads are a barometer of economic health and market sentiment. Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data.

From www.calculatedriskblog.com

Calculated Risk Euro Bond and CDS Spreads Widen Spreads Widen On Bonds when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data. bond yield spreads are a barometer of economic health and market sentiment. a bond credit spread, also known as. Spreads Widen On Bonds.

From www.ecb.europa.eu

Exploring the factors behind the 2018 widening in euro area corporate Spreads Widen On Bonds the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. bond yield spreads are a barometer of. Spreads Widen On Bonds.

From www.ecb.europa.eu

Exploring the factors behind the 2018 widening in euro area corporate Spreads Widen On Bonds Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data. A widening spread generally indicates that investors demand a higher return for. when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. the difference between the yields of two different. Spreads Widen On Bonds.

From trendinvestorpro.com

Composite Breadth Model Takes a Turn, S&P 500 Breadth Deteriorates Spreads Widen On Bonds Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data. A widening spread generally indicates that investors demand a higher return for. a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities. bond yield spreads are. Spreads Widen On Bonds.

From www.clearfinances.net

Bond Spreads Explained Key Metric for Credit Risk Clear Finances Spreads Widen On Bonds when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. credit spreads, also known as treasury spreads, are the difference between. Spreads Widen On Bonds.

From www.phipost.com

Spreads Widen Across The Credit Complex, But Lower Rates Keep US Spreads Widen On Bonds Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. A widening spread generally indicates that investors demand a higher return for. when yield spreads widen. Spreads Widen On Bonds.

From www.phipost.com

USD Cash Spreads Widen But Bonds Rise With Lower Rates Across The Curve Spreads Widen On Bonds Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data. A widening spread generally indicates that investors demand a higher return for. when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. bond yield spreads are a barometer of economic. Spreads Widen On Bonds.

From www.phipost.com

US Credit Spreads Widen, But Corporate Bonds Rise On Lower Rates Spreads Widen On Bonds A widening spread generally indicates that investors demand a higher return for. bond yield spreads are a barometer of economic health and market sentiment. Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data. credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity. Spreads Widen On Bonds.

From bondblox.com

Chinese Developers` Bond Spreads Widen as Focus on Three Red Lines Spreads Widen On Bonds credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm). A widening spread generally indicates that investors demand a higher return for. Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data. the difference between the yields of two different bonds, called a. Spreads Widen On Bonds.

From www.youtube.com

Bond Spreads Explained Fundamentals YouTube Spreads Widen On Bonds the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. a bond credit spread, also known as a yield spread, is. Spreads Widen On Bonds.

From www.phipost.com

Spreads Widen Across The Credit Complex, But Lower Rates Keep US Spreads Widen On Bonds A widening spread generally indicates that investors demand a higher return for. when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. bond yield spreads are a barometer of economic health and market sentiment. the difference between the yields of two different bonds, called a bond. Spreads Widen On Bonds.

From www.phipost.com

Spreads Widen Across The Credit Complex, But Lower Rates Keep US Spreads Widen On Bonds credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm). bond yield spreads are a barometer of economic health and market sentiment. A widening spread generally indicates that investors demand a higher return for. Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs. Spreads Widen On Bonds.

From www.bloomberg.com

Watch Junk Energy Bond Spreads Widen by Most on Record Video Bloomberg Spreads Widen On Bonds when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. A widening spread generally indicates that investors demand a higher return for. a bond credit spread, also known as a yield spread, is the difference in yield between two bonds with similar maturities but different credit qualities.. Spreads Widen On Bonds.

From www.reuters.com

El Salvador bond spreads widen to fresh record Reuters Spreads Widen On Bonds the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. a bond credit spread, also known as a yield spread, is. Spreads Widen On Bonds.

From seekingalpha.com

Another Worry Yield Spreads On Corporate Bonds Widen Seeking Alpha Spreads Widen On Bonds when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. bond yield spreads are a barometer of economic health and market sentiment. Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data. a bond credit spread, also known as. Spreads Widen On Bonds.

From www.researchgate.net

Marketwide bond yield spreads of financial vs. industrial bonds (a Spreads Widen On Bonds when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data. credit spreads, also known as treasury spreads, are the difference between a corporate bond's yield to maturity (ytm). the. Spreads Widen On Bonds.

From seekingalpha.com

High Yield Bond Spreads Continue to Widen Seeking Alpha Spreads Widen On Bonds the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing in. Corporate bond spreads widened on tuesday and are expected to widen further after the latest jobs data. a bond credit spread, also known as a yield spread, is the difference in yield between. Spreads Widen On Bonds.

From allstarcharts.com

Breaking Down Credit Spreads All Star Charts Spreads Widen On Bonds when yield spreads widen between bond categories with different credit ratings, all else equal, it implies that the market is factoring. bond yield spreads are a barometer of economic health and market sentiment. the difference between the yields of two different bonds, called a bond spread, can help you understand the potential risks and rewards for investing. Spreads Widen On Bonds.